The Single Strategy To Use For Hsmb Advisory Llc

9 Simple Techniques For Hsmb Advisory Llc

Table of ContentsMore About Hsmb Advisory LlcGetting My Hsmb Advisory Llc To WorkThe Greatest Guide To Hsmb Advisory LlcHsmb Advisory Llc - Truths

Life insurance policy is especially essential if your household is dependent on your income. Industry specialists recommend a policy that pays out 10 times your yearly income. These might consist of home loan repayments, impressive finances, credit score card financial debt, taxes, child treatment, and future university expenses.Bureau of Labor Statistics, both spouses worked and brought in income in 48. They would certainly be likely to experience economic difficulty as a result of one of their wage income earners' fatalities., or exclusive insurance you get for yourself and your family members by calling wellness insurance policy companies straight or going with a wellness insurance coverage agent.

2% of the American populace was without insurance policy protection in 2021, the Centers for Disease Control (CDC) reported in its National Facility for Health Stats. Even more than 60% got their protection via an employer or in the exclusive insurance industry while the remainder were covered by government-subsidized programs consisting of Medicare and Medicaid, veterans' advantages programs, and the government industry developed under the Affordable Treatment Act.

Not known Facts About Hsmb Advisory Llc

If your earnings is reduced, you may be just one of the 80 million Americans who are qualified for Medicaid. If your income is moderate however doesn't extend to insurance protection, you might be eligible for subsidized insurance coverage under the government Affordable Treatment Act. The ideal and least costly option for salaried workers is normally getting involved in your employer's insurance program if your employer has one.

According to the Social Safety Administration, one in four employees getting in the labor force will come to be impaired before they get to the age of retirement. While health insurance policy pays for hospitalization and medical bills, you are frequently burdened with all of the expenditures that your paycheck had covered.

This would be the most effective choice for protecting inexpensive impairment coverage. If your company doesn't supply long-lasting protection, right here are some points to think about prior to purchasing insurance coverage on your own: A plan that ensures income substitute is ideal. Lots of plans pay 40% to 70% of your income. The cost of disability insurance coverage is based on several factors, including age, way of living, and health and wellness.

Before you acquire, review the small print. Lots of strategies require a three-month waiting period before the coverage kicks in, give an optimum of three years' well worth of insurance coverage, and have substantial plan exclusions. In spite of years of improvements in car safety and security, an approximated 31,785 people died in web traffic accidents on U.S.

The Definitive Guide to Hsmb Advisory Llc

Comprehensive insurance policy covers burglary and damages to your car as a result of floodings, hail storm, fire, criminal damage, dropping objects, and animal strikes. When you finance your auto or lease a vehicle, this type of insurance coverage is obligatory. Uninsured/underinsured motorist () coverage: If an uninsured or underinsured chauffeur strikes your vehicle, this protection spends for you and your passenger's medical costs and may likewise make up lost income or make up for pain and suffering.

Employer protection is frequently the very best option, yet if that is unavailable, obtain quotes from numerous providers as numerous provide discount rates if you acquire even more than one sort of coverage. (https://www.taringa.net/hsmbadvisory/health-insurance-st-petersburg-fl-your-ultimate-guide_5bpkou)

The 25-Second Trick For Hsmb Advisory Llc

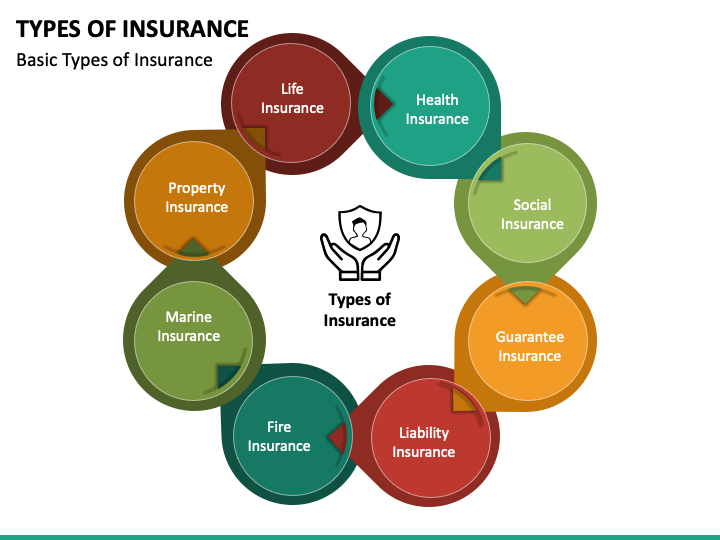

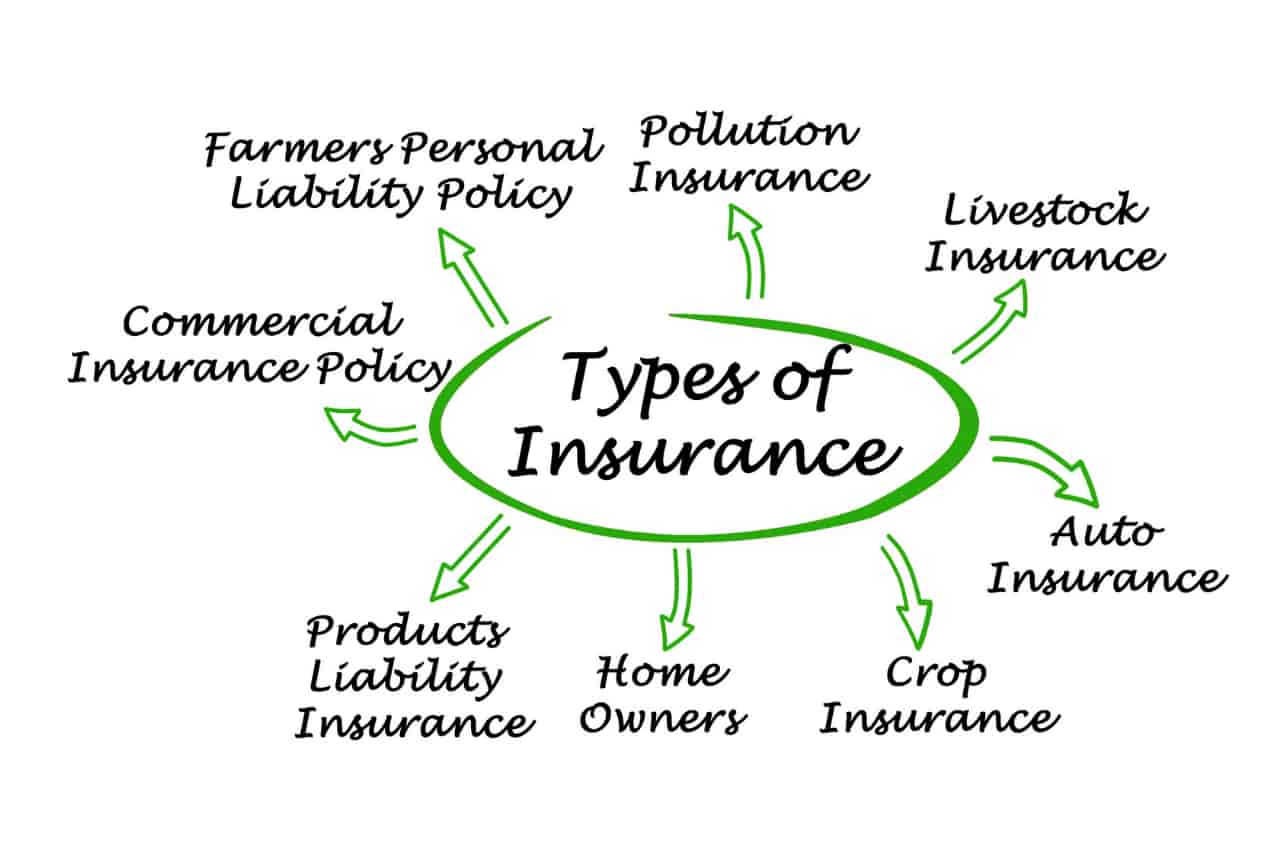

In between medical insurance, life insurance policy, impairment, liability, long-lasting, and also laptop insurance, the job of covering yourselfand thinking of the limitless opportunities of what can take place in lifecan feel frustrating. However when you recognize the fundamentals and make certain you're adequately covered, insurance can enhance economic self-confidence and well-being. Right here are the most essential sorts of insurance policy you need and what they do, plus a couple tips to avoid overinsuring.

Various states have different regulations, yet you can anticipate health and wellness insurance coverage (which lots of people survive their company), car insurance policy (if you own or drive a lorry), and house owners insurance (if you possess residential property) to be on the checklist (https://forums.hostsearch.com/member.php?256834-hsmbadvisory). Compulsory kinds of insurance policy can change, so look into the most up to date legislations every now and then, specifically prior to you renew your policies